Welcome to Dant Chesser’s Digest, my monthly newsletter, where I will provide legislative and community updates for you as your state representative for House District 71. Please reach out to my office at h71@iga.in.gov if you have any questions or concerns.

Thank You for Attending My Town Halls

On Feb. 26 and Feb. 28, I held two separate town halls for our community. Thank you to everyone who attended and participated in our discussion. At our senior listening session, we had a great discussion about Medicare and potential funding cuts at the federal level. Thank you to Steve Morris from the American Association of Retired Persons (AARP) for providing expertise and answering our questions.

At my mid-session town hall, I provided an update on the legislation moving through the Statehouse. We talked about my bill to increase options for Medicare Supplement insurance, K-12 education funding, public safety and more. I plan on continuing to provide updates until the end of session in April. Once again, thank you for coming to my two events. I hope to host another town hall soon!

My Bill for Medicare Supplement Insurance is in the Senate

On Feb. 17, House Bill 1226 passed a vote on the House floor and is in the Senate for consideration. I authored this bill to provide cost-saving opportunities to seniors by allowing them to take advantage of “The Birthday Rule.” This gives those enrolled in Medigap coverage the chance to shop for Medicare Supplement plans without underwriting within 60 days of their birthday, as long as they maintain the same type of plan.

I’m excited that this bill passed the House and is in the Senate. I authored this legislation after hearing from a constituent who needed to find affordable insurance. Jeffersonville is on the state border, and “The Birthday Rule” exists in Kentucky but not our state. Thanks to those who brought this forward to close Indiana’s gap in our Medicare coverage.

Our health care system is extremely difficult to navigate. Insurance is confusing, and it gets even more convoluted when states have differing protections. HB 1226 will streamline the process of Medicare Supplement insurance and cut costs for our seniors. In other states where “The Birthday Rule” exists, seniors have saved close to $800, which makes a difference to those on a fixed income. They’re able to shop around for a program that works best for them, and this bill protects them from discriminatory prices due to medical history or health status.

I promised myself I would do something to provide our seniors with some relief. For those dependent on Medicare coverage, HB 1226 can streamline Medicare Supplement insurance and make it a little bit more cost-effective. I look forward to the consideration of my bill in the Senate.

You can read more about my bill at this link.

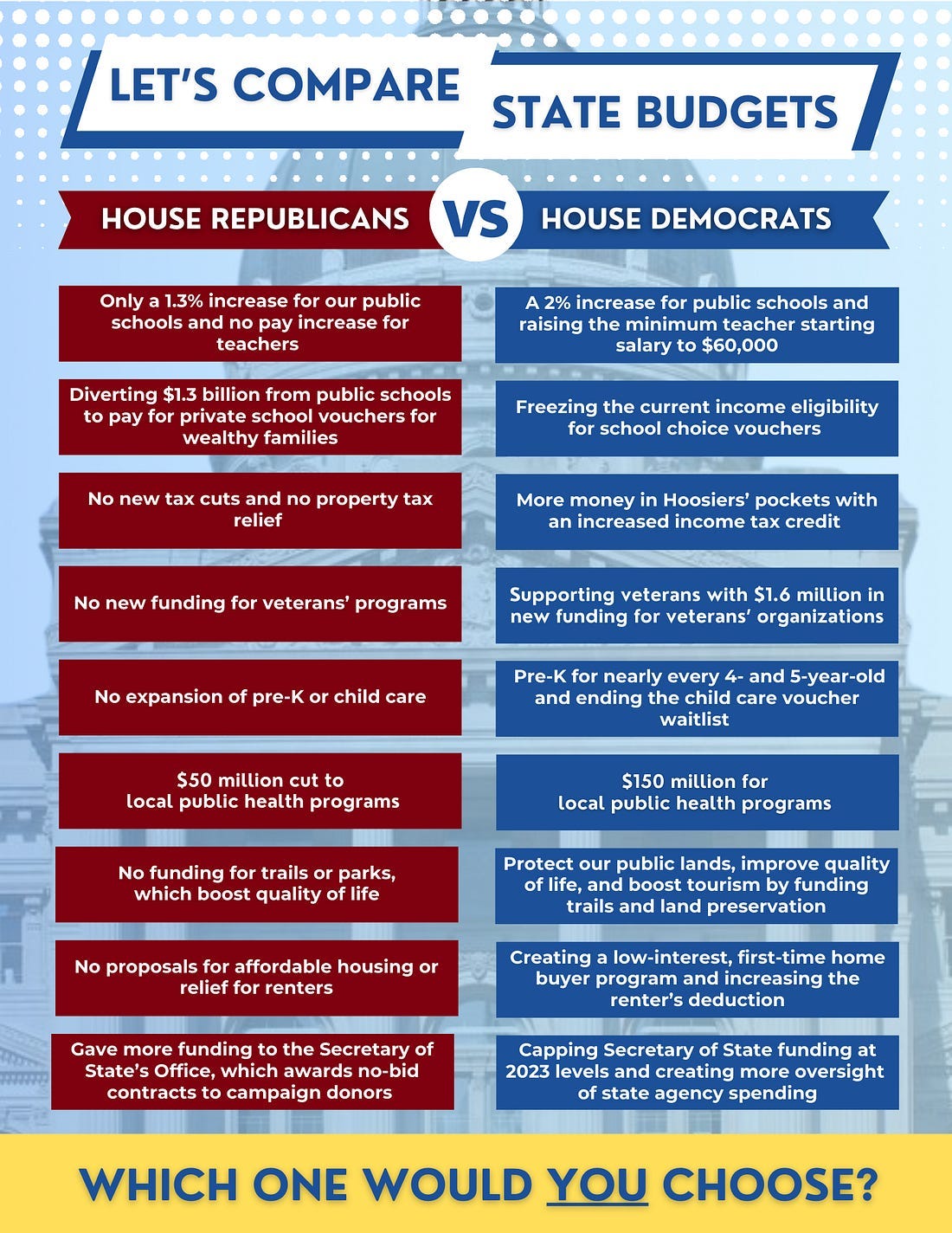

House Majority Blocks Budget Proposals That Benefit Hoosiers

In late February, the House passed the two-year, $46 billion state budget proposal, which now heads to the Senate for consideration. The Indiana House Democratic Caucus presented our proposal for the budget, "A Budget for the People." House Republicans rejected including any of our ideas in the budget bill during the second reading amendment process to help working Hoosiers get ahead.

The House Democrat state budget proposal had one purpose in mind: to help our people. It’s taxpayers' money and it should be spent on programs they want. Our budget proposal would have provided balanced tax relief, supported K-12 public education, bolstered public health and lowered health care costs.

House Democrats’ budget would have helped Hoosiers during these unprecedented times. From education to public health, we can do more to improve the quality of life in our state. The Republican opposition to these proposals was a vote against Hoosiers. Here’s a snapshot of the differences between the Democratic and Republican budget proposals:

Here Come the Senate Bills!

At the mid-point of each legislative session, the chambers of the General Assembly switch bills. The legislation we authored in the House heads to the Senate and vice versa. Over the next couple of months, I’ll be hearing, amending and voting on bills authored by Indiana’s state senators.

Here’s a list of concerning bills to watch during the second half of session:

Senate Bill 1 “Property Tax Relief”:

SB 1 was originally filed as Gov. Braun’s property tax reform plan. However, the bill changed significantly during its time in the Senate. With these changes, SB 1 would cost local governments $1.4 billion over the next three years. School districts would lose almost $371 million. This loss in funding would have a very real impact on our communities. We will continue to have potholes in our roads. Our firefighters and police may lose their jobs as the dollars for local public safety shrink. Student class sizes will get bigger since public schools will struggle to pay for additional teachers.

The bill prioritizes tax cuts for businesses over Hoosiers, providing little to no relief for homeowners. Homeowners would only save an average of $48.10 on their 2026 property tax bill. The House Ways and Means Committee heard testimony on the bill earlier this month. House Republicans announced their intent to completely strip SB 1 and put their plan for property tax relief in the bill. They have yet to vote on the bill SB 1 in the House Ways and Means Committee.

Senate Bill 2 “Medicaid Matters”:

SB 2 limits the Healthy Indiana Plan (HIP) to only 500,000 members, leaving more than 200,000 Hoosiers without access to healthcare. The bill also requires individuals to work a minimum of 20 hours a week to be eligible for HIP, potentially putting Hoosiers facing barriers to employment at risk. There are exceptions for those deemed medically unable to work, pregnant women and individuals in a rehabilitation program. There’s also a 90-day grace period for individuals recently released from prison.

Additionally, the bill prohibits marketing for Medicaid and its programs, following a similar executive order Gov. Braun passed earlier this year. Marketing and advertising are essential to ensuring that Hoosiers are aware of the health care services available to them. This bill will further harm Hoosiers already struggling to make ends meet by making healthcare less accessible.

The bill was referred to the House Committee on Public Health and was heard on March 18. It was amended in committee to remove the eligibility limit for the HIP program, but the work requirements and advertising portions still stand. SB 2 is headed to the House floor for a vote.

Senate Bill 287 “School Board Matters”:

This bill would require school board candidates to declare their party and run in partisan primaries to be on the ballot in the November general election. School board candidates would be listed on the ballot as Democrat or Republican.

This legislation would severely damage public schools by allowing the partisan arguments from D.C. to take place in our children’s schools. School board members’ allegiance should be to our children not a political party. It would also add barriers to running for a school board by requiring a community member to run in a primary as well as a general election.

This bill would also prohibit federal employees from serving on school boards because of the Hatch Act. The Hatch Act prevents individuals who are paid with federal dollars from running in partisan elections. Board members may be forced to resign from their positions. The bill passed in the House Committee on Elections and Apportionment and is headed to the House floor for a vote.

Senate Bill 289 “Nondiscrimination in Employment and Education” :

This bill is another round of anti-diversity, equity and inclusion (DEI) legislation authored by Republicans to roll back the progress painstakingly made over the last couple of decades.

SB 289 would eliminate DEI offices in state agencies and K-12 educational institutions. Schools would be prohibited from teaching students that “one race, sex, ethnicity, religion, or national origin is inherently superior or inferior to another.” This vague phrasing would create an environment where educators don’t feel comfortable teaching the history of slavery, racism and discrimination in our country, which is vital to fostering an informed citizenry.

The bill was referred to the House Committee on Judiciary and has yet to receive a hearing.

Senate Bill 518 “School Property Taxes”

Senate Bill 518 would require public schools to share their property tax revenue with charter schools. School districts with at least 100 students attending a charter would be required to share their operations fund levy with nearby charters. The operation fund levy pays for schools’ day-to-day expenses, including teachers’ salaries, classroom supplies, building maintenance, etc.

It also mandates that all public school districts must share debt service levy funds with eligible charter schools, regardless of their enrollment numbers. These funds cover lease rentals, general obligation bonds, interest for tax anticipations, etc. Basically, this money is used by public schools to pay for any outstanding debt.

If passed, public schools would lose $124.4 million to charter schools over the next three years. This bill, coupled with SB 1, would severely underfund our public schools and reduce the quality of the education our students receive.

The House Ways and Means Committee heard testimony on the bill earlier this month, and it was held for a vote at a later date.

Protecting Dolly Parton’s Imagination Library

3,000 children in Clark County and 3,500 in Floyd County at risk of losing this program.

The passed state budget proposal includes no funding for Dolly Parton’s Imagination Library. Parton’s early literacy program mails free books to children under the age of five regardless of income or location. The program grew to all 92 counties in Indiana with a matching grant of $6 million in 2023.

I fully support restoring and increasing state funding for Dolly Parton’s Imagination Library. I’ve received more calls from Hoosiers in my area about restoring this funding than any other cut in the state budget. As of 2023, 1 in 5 third graders lacked basic reading skills. This program is a much-needed investment in Indiana’s future.

Dolly’s Library is free to the children enrolled, and local Imagination Library partners only pay 50% of their local program cost with the remaining 50% paid by the state. As we consider the role of public funding to support Hoosier families, I implore you to consider how we foster a culture of lifelong learning. It starts with the family. Helping families establish a love of reading is the best way to spark the fire of gaining the knowledge contained in books. Future educational metrics, future workforce readiness, and future entrepreneurial goals depend upon our success in early childhood.

Dolly Parton’s foundation issued the following quote about the elimination of the program:

“We are hopeful that Governor Braun and the Indiana Legislature will continue this vital investment by restoring the state’s funding match for local Imagination Library programs. The beauty of the Imagination Library is that it unites us all — regardless of politics — because every child deserves the chance to dream big and succeed. For the past two years, the State of Indiana has been a proud partner in bringing Dolly Parton’s Imagination Library to over 125,000 Hoosier children each month. Together, we’ve helped nurture a love of reading, given families precious moments of joy, and built a foundation for lifelong learning.”

In late February, Gov. Braun responded to the public outcry about the Imagination Library by calling on First Lady Maureen Braun to form a public-private partnership to fund this program. However, this program is a drop in the budget bucket compared to other programs – something the state can certainly fund. We should make this program a guarantee for our children by including it in the budget instead of leaving it up to wealthy donations.

Rest assured, House Democrats will work “9 to 5” to reinstate Dolly Parton’s library. As always, please email my office at h71@iga.in.gov with any thoughts, questions, or concerns

Photo Courtesy of the DollyWood Foundation

Relevant Articles

'We'd love to have you': Illinois secession bill earns Indiana House approval

'Smoke and Mirrors': Democrats, critics denounce Republican budget proposal over school funding

Halfway through the 2025 legislative session, Indiana has passed several big-ticket items so far

Indiana bill to shift more dollars from traditional publics to charter schools earns Senate approval

Indiana Senate passes Medicaid, HIP overhaul despite concerns about access, coverage

Costs of child care now outpace college tuition in 38 states, analysis finds

Jeffersonville, Utica fire board poised to approve fire territory despite local opposition

In service,

Wendy

I am impressed with the comparison of how the Democrats & Republicans deal with issues. Democrats appear to know what to do and are doing some of what is needed.

With changes constantly happening, in our USA because of the White House Leaders in the oval office; concerns me and repulses me. I did not want to believe some "Dictator" actions would be happening - but they are. What can I do about the unrealistic actions? I am glad at the state level this does not appear to be so relevant.

I'm on Medicaid because when I worked at the Jeffersonville Township Public Library they refused to hire me full-time. I was promised a full-time position after I got my masters degree in library science. I was only allowed to work 20 hrs a week so I was forced to be on Medicaid. I was harassed by the library director until I was forced to quit. He harassed me because I fought censorship! I've been unemployed since December 2023. I've been trying to find employment but no luck. I can't be without health insurance. My student loan payment went up without my knowledge and now I have to choose between paying my student loans and paying other bills. I wanted you to know what your people are going through. I'm happy to discuss my issues further if you are interested.