Welcome to Dant Chesser’s Digest, my monthly newsletter, where I will provide legislative and community updates for you as your state representative for House District 71. Please reach out to my office at h71@iga.in.gov if you have any questions or concerns.

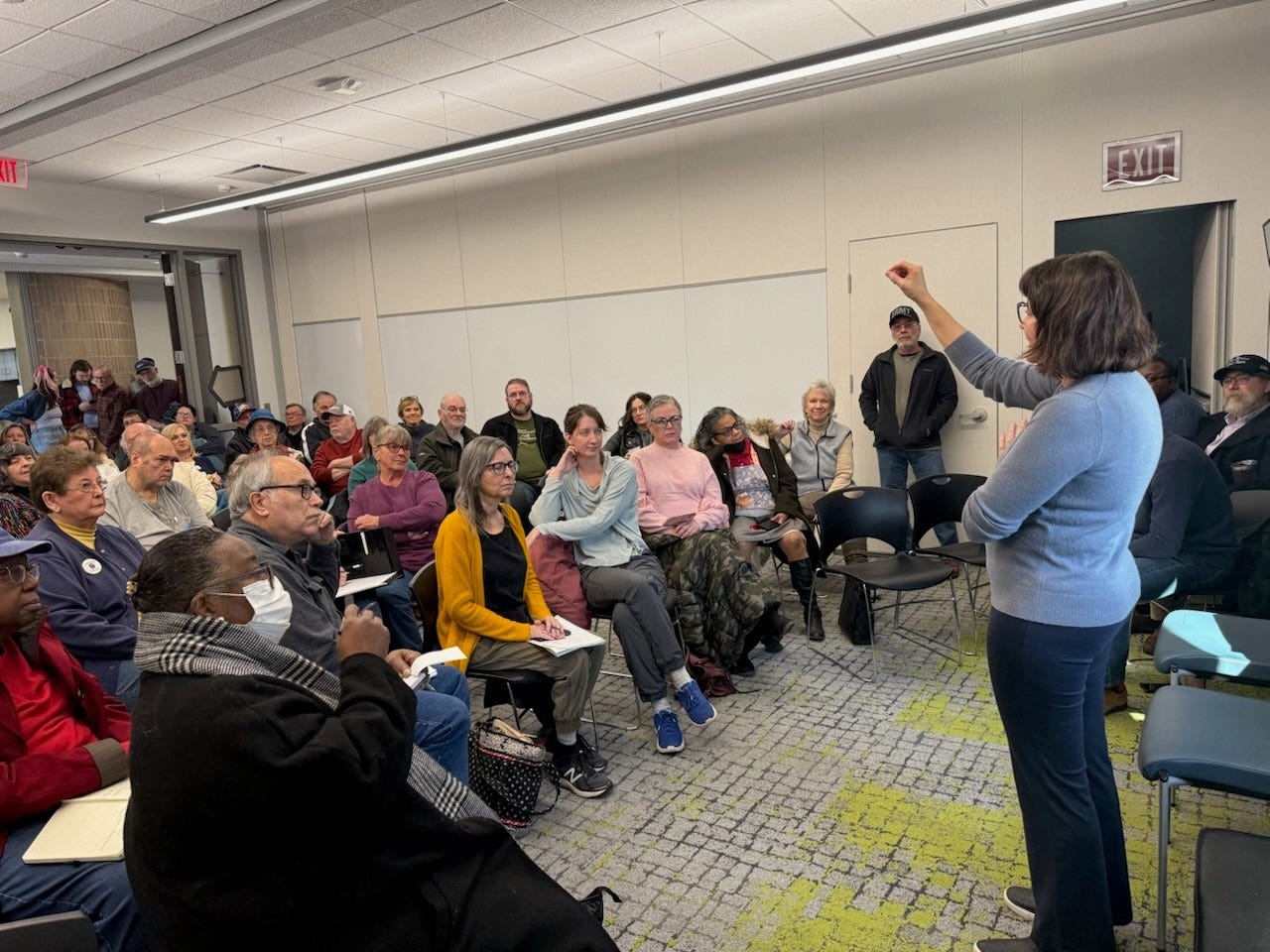

Thank You for Attending My Town Hall! The next one will be on Feb. 28.

On Saturday, Jan. 28, I held a town hall for the start of the 2025 legislative session. Thank you to everyone in the community who attended and participated in the discussion. Time is money, and I am thankful that many of you chose to share your time with me, especially during a busy time of year.

For those unable to attend, we discussed my legislation for the 2025 session, including a bill to create an employee child care assistance partnership program. Another big topic was the rising cost of health care. Kentucky has different state laws governing its Medicaid and Medicare program which can be a source of confusion since we live close to the border. That’s one of the reasons why I authored a bill on Medicare Supplement insurance, similar to existing legislation in Kentucky. If passed, my legislation would stop insurance issuers from denying a policy or changing a policy due to someone’s medical history. We can do more to bring down the cost of health care and streamline insurance claims.

I’m hosting another town hall for the halfway point of the legislative session on Feb. 28 at 3 p.m. ET. The town hall will be at the Clarksville Library in meeting rooms A & B (1312 Eastern Blvd, Clarksville, IN 47129).

At the mid-point of session, the Senate and the House will swap the legislation that’s passed in each chamber. We’ll be able to discuss the specific bills that legislators are passing in Indianapolis at my next town hall. I will also give an update on my legislation!

Everyone is invited to the town hall regardless of political party or affiliation. My goal is to serve everyone in House District 71. I hope you will attend, share your concerns and learn about bills moving through the Statehouse. Please feel free to spread the word and share the below graphic. If you have any questions about the event, please reach out to h71@iga.in.gov.

Once again, thank you to everyone who came to my January town hall. I hope to see you all again at the next one on Feb. 28!

Watch An Interview with WFYI About My Legislative Priorities

At the start of the legislative session, I had the opportunity to interview with WFYI’s Jon Schwantes. I talked about bipartisanship and my legislative priorities for this year. I want to keep you informed about my efforts at the Statehouse, so I attached the video below:

Child Care Bills Moving through the Statehouse

The most discussed topic at my January town hall was child care. I shared information about my bill, House Bill 1430, but I wanted to inform you of other child care legislation in the Statehouse. Including my bill, lawmakers filed nine pieces of legislation.

It’s a major topic of discussion at the Statehouse for good reason. According to a study by CNBC, Indiana is the worst state in the nation for access to child care. Our state has only 772 licensed care facilities. It’s the scarcity of care that makes child care so expensive. For center-based care, parents spend an average of $13,736 each year for an infant and $11,965 for a toddler. Indiana must do better for our parents and our children.

A full list of the year’s child care legislation is available below. The bolded and italicized bills are moving through the General Assembly:

House Bill 1253 Child Care (headed to the House Floor for a vote)

Requires the Division of Family Resources to create an organizational license for multi-site child care centers operating under one owner. Also removes the requirement that a child who receives child care from a school has to have a parent enrolled or employed by the same educational institution.

House Bill 1248 Child Care and Development Fund (will receive a committee hearing)

Ensures that foster care households are eligible for child care assistance through the Child Care and Development Fund (CCDF).

Senate Bill 463 Child Care Matters (headed to the Senate floor for a vote)

Cleans up regulations for child care facilities like staff-to-child ratios and maximum group sizes. Adds additional rules for the micro center pilot program. Creates the local child care assistance program to help Indiana’s counties expand the availability of care in the area.

If you’re having trouble finding child care, you can click this link to visit the website for Child Care Answers, an organization that connects parents with local resources.

Testifying on House Bill 1208 to Increase Jail Commissary Fund Reporting

On Jan. 28, I testified in support of House Bill (HB) 1208 in the House Committee on Local Government. HB 1208 requires the State Board of Accounts (SBOA) to create training requirements for the sheriffs responsible for their county’s commissary funds. The bill also requires the sheriff's office to report receipts and disbursements from their commissary fund to the county fiscal body three times a year. This legislation was amended in committee to increase the number of reporting requirements from three times a year to four. On Feb. 3, it passed unanimously out of the House and is headed to the Senate.

I gave the following testimony in the committee:

“Former Clark County Sheriff Jamey Noel plead guilty to 27 charges, including theft, official misconduct, tax evasion and money laundering. He stole close to $458,000 from the county’s commissary fund. If you google search the phrase ‘former Indiana Sheriff,’ it pulls up local news reports of theft by Noel, his wife and daughter. It’s a real-life tabloid scandal that’s not going away.

“We have lived under this shadow for 18 months, and I fear it will wrongly implicate all of us who work to improve our community. How did this happen? What went wrong? It was an abuse of trust by an elected official who ignored his responsibility to the public. It was a blatant abuse of power that was carried out through abject control, threats and intimidation. It was a lack of oversight by others sidelined in their duty to protect public trust and accountability by those with authority.

“Now is the time to fix it. It’s been difficult to right the wrongs that Noel did to our community. But looking forward, we can take the initial steps to prevent future bad actors. I stand in support of House Bill 1208, and I thank the author for allowing me to join this conversation. I did author my own commissary fund bill, but I recognize it’s better to jump onboard a moving train than jumpstart a new one. While I support this bill, I believe it can be made stronger by increasing the reporting requirements from only a few times a year.

“The best step we take is always the next one: first steps, good steps. Let’s make it better.”

Footage of my testimony at this link from the time stamp 7:00 to 10:58.

Crafting the State Budget: Gov. Braun presents his proposal

Every two years, we craft the state budget. The process starts with the presentation of the governor’s budget. Then the budget bill (House Bill 1001) is filed in the House, and we make our changes. Next, the budget moves to the Senate for their consideration. The final step of the process is the House and Senate work together to perfect the budget and send it to the Governor’s desk for his signature. On Jan. 16, Gov. Braun presented his “Freedom and Opportunity” proposal to start the budget process.

House Democrats support a couple of things in Braun’s budget. He wants to put an end to the IEDC’s blank check by not re-upping the $500 million they received in the 2023. Braun also intends to fully fund the Medicaid forecast and provide money for the 76,000 children on the waitlist for the Child Care Development Fund (CCDF).

However, a majority of the budget makes massive cuts to programs Hoosiers need. Here’s a breakdown of some of Braun’s proposed cuts:

Cuts for Public Schools: Out of his proposed 2% increase for K-12 education, only 1.3% would go to our public schools. The money increase will be split with charters and the private school voucher program. Clarksville Community School Corporation would receive a cut under this proposal.

Universal Vouchers: Removes the income threshold for the Choice Scholarship Program. This means families in any tax bracket, including millionaires, would be able to use taxpayer money for their child's private school tuition. There’s also no guarantee that tax dollars used for private school vouchers go toward local private schools. Taxpayers in Clark and Floyd Counties could be footing the bill for private schools in Indianapolis or Fort Wayne that have no impact on our community.

Cuts Public Health Grants: Cuts the Health First Indiana Program by one-third. This funding was distributed to 92 of Indiana’s counties that used the grants to improve their community’s health outcomes. Clark and Floyd Counties used this money for chronic disease screenings, immunizations and Maternal and Child health services (car seat distribution, safe sleep education and more).

Defunds or Eliminates Vital Commissions: Eliminates the Indiana Commission for Women (ICW) and the Indiana Native American Indian Affairs Commission (INAIAC). Cuts funding for the Indiana Civil Rights Commission (ICRC) by close to $750,000.

State Agencies: Braun wants to cut spending for all state agencies by 5%.

Cuts READI: Will not provide funding for the READI program. READI provided matching grants to local communities for development projects including increasing available housing, kickstarting small businesses and improving infrastructure. The Jeffboat property received $6.5 million in READI funding in 2024.

Social Services: Flat funds the CHOICE program, which helps elderly and disabled Hoosiers stay in their homes. Flat funds some of Indiana’s food banks.

Gov. Braun also proposed his plan for tax relief, including additional tax holidays, ending taxes on retirement income, and additional property tax relief (included in Senate Bill 1). Hoosiers desperately need tax relief, but these proposals would drastically cut the budgets of state and local governments. These tax deductions would cut close to $696 million from our state revenue and cost our local governments roughly $300 million each year. People need tax relief, but we have to balance the relief we provide with the needs of our local governments.

I believe we can write a fiscally responsible budget while still providing Hoosiers with programs that improve their quality of life. I look forward to continuing to work on the state budget. As always, please contact h71@iga.in.gov with any thoughts or concerns.

Relevant Articles:

Lawmakers look for solutions to Indiana's problem with child-care access and affordability

Health advocate worries Medicaid crackdown under Braun will increase uninsured

House Republicans propose redrawing Indiana’s boundaries, adding Illinois counties

https://www.wishtv.com/news/politics/redrawing-indiana-illinois-boundaries/

These 13 bills would change Indiana's K-12 education system

https://www.wfyi.org/news/articles/these-13-bills-would-change-indianas-k-12-education-system

Bills halving early voting period, closing primaries head to Senate floor

Indiana Gov. Mike Braun focuses on immigration and tax cuts in State of the State address

State approves reduced Duke Energy rate hike to modernize grid, increase security

In service,

Wendy